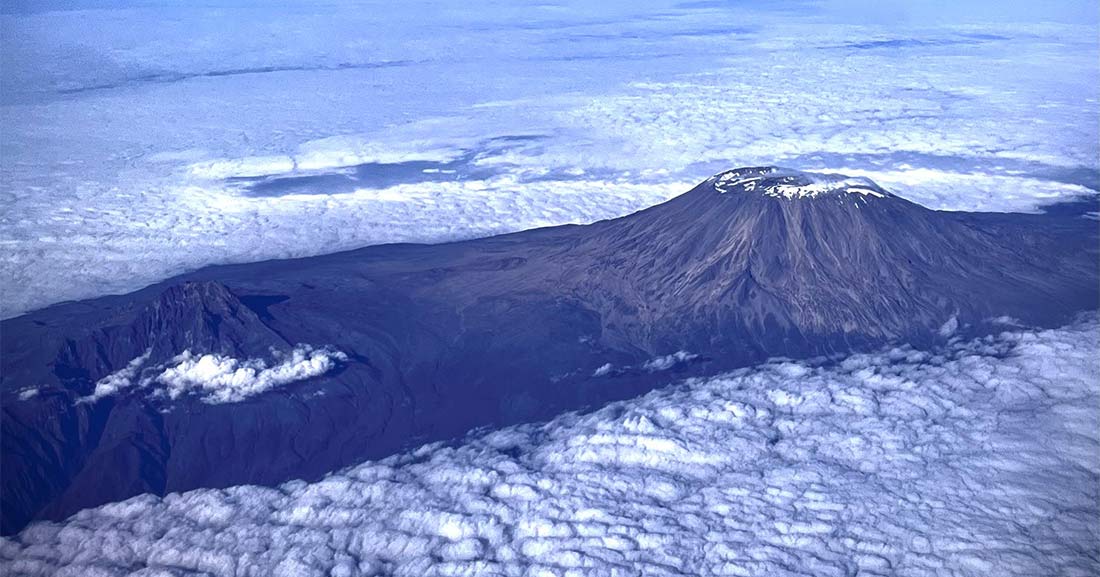

Amid the excitement of planning your Kilimanjaro trek, don’t overlook the importance of travel insurance. This insurance should cover altitudes of 6,000 meters (19685.04 feet). In this article, we explore the crucial role that travel insurance plays. We require travel insurance to climb Kilimanjaro. It is there to ensure a safe and secure Kilimanjaro climbing experience.

Altitude Considerations

Climbing Kilimanjaro involves reaching high altitudes. The air is thin and the risk of altitude-related issues increases. It’s imperative to select travel insurance that provides coverage up to at least 6,000 meters. This altitude high ensures trekkers coverage for potential health challenges associated with high-altitude environments to the Summit

Trekking vs. Mountaineering

When selecting travel insurance for a Kilimanjaro trek, it’s essential to distinguish between trekking and mountaineering coverage. Kilimanjaro is a trekking expedition rather than a technical mountaineering climb. There are no ropes or technical equipment required to climb Kilimanjaro.

Therefore, your insurance policy should explicitly cover trekking activities. Ensure that it addresses the specific challenges and risks associated with high-altitude trekking.

Emergency Medical Evacuation

The travel insurance policy for Kilimanjaro should include coverage for emergency medical evacuation. In the event of a serious illness or injury, especially at high altitudes, timely evacuation becomes critical.

This coverage ensures that you can be safely transported to a medical facility equipped to handle altitude-related conditions.

We offer helicopter evacuation included in your climb price. To be eligible for it, you’re required to have trip insurance.

You’ll receive a card like the one below at the trip briefing. Your information will be on the back of the card. Make sure it is correct.

We will also send your information to AMREF before you climb. That way you don’t have to worry about registering with them during a potential emergency.

Trip Cancellation and Interruption

Planning a Kilimanjaro expedition requires time and resources. Unforeseen circumstances like trip cancellations can be financially burdensome. Travel insurance with coverage for trip interruptions brings peace of mind. It should reimburse non-refundable expenses if your plans are disrupted.

Coverage for Adventure Activities

Kilimanjaro trekking involves physical exertion and exposure to the elements. Ensure that your travel insurance policy covers adventure activities. It should provide adequate coverage for injuries sustained during the trek. This includes coverage for accidents, medical expenses, and emergency evacuation.

Repatriation

For Kilimanjaro, your travel insurance must cover repatriation, not just medical needs.

Repatriation ensures a safe return to your home country in case of severe illness, injury, or, unfortunately, a fatality.

Kilimanjaro is remote and poses challenges for medical emergencies at high altitudes. Repatriation coverage is crucial. It guarantees that, if needed, you can be transported back to your home country with access to familiar medical facilities.

This coverage provides financial support for the return journey. It also gives peace of mind to both you and your loved ones. Review and understand the repatriation provisions in your travel insurance for comprehensive coverage.

Policy Exclusions and Limitations

Check your insurance policy for exclusions and limitations. Some policies may not cover high-altitude activities. Choose one that explicitly covers trekking up to 6,000 meters.

Final Thoughts

In conclusion, travel insurance is a must for a Kilimanjaro trek. It provides confidence, financial protection, and essential support during emergencies. Focus on policies that cover high-altitude trekking to ensure comprehensive protection for Kilimanjaro’s unique challenges.